Streamlining Item Refunds in QuickBooks: A Comprehensive Guide

September 25, 2023 19:50 pm

Anuradha Mitra

Introduction:

Having already explored Part 1, “Setting Up Store,” followed by Part 2, “A Comprehensive Guide to Replenishing Items,” and Part 3, “Understanding Item Expenses,” we now embark on the next phase of our journey: “Item Refunds”. Item refunds are a critical aspect of managing customer transactions in QuickBooks. Whether it’s a return of a purchased item or a credit for an unpaid cash sale, handling refunds efficiently is essential for maintaining accurate financial records. In this article, we’ll delve into the nuances of item refunds and explore the two primary methods: the “Refund Receipt” for immediate refunds and the “Credit Memo” for credit returns of item sales. Understanding when and how to use these methods is crucial for maintaining financial integrity and customer satisfaction.

Refund A Cash Sale of Item (Paid)

When a customer decides to return an item they’ve purchased, it is necessary to ensure that your inventory records accurately reflect this change. In the case of a sale paid by cash, where the customer has already made a payment, you’ll typically use the “Refund Receipt” API to process the refund.

Creating a Refund Receipt

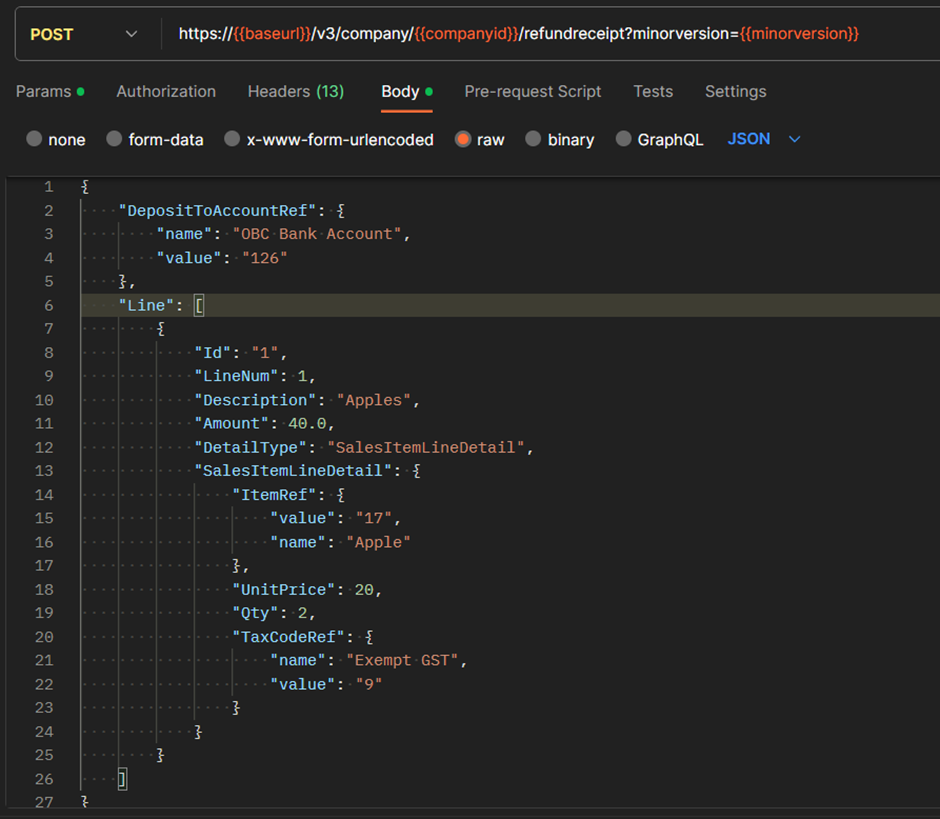

To create a Refund Receipt, you’ll need to provide the following information in the request body:

- At least one line that describes the item being refunded.

- A “DepositToAccountRef.”

Example: Let us imagine that the customer from the earlier example of a customer wanting to return 2 apples. In that case, the customer will be refunded for those 2 apples, and we have to use the Refund Receipt API to track inventory. Since the customer will be returning the apples, Apple inventory will increase.

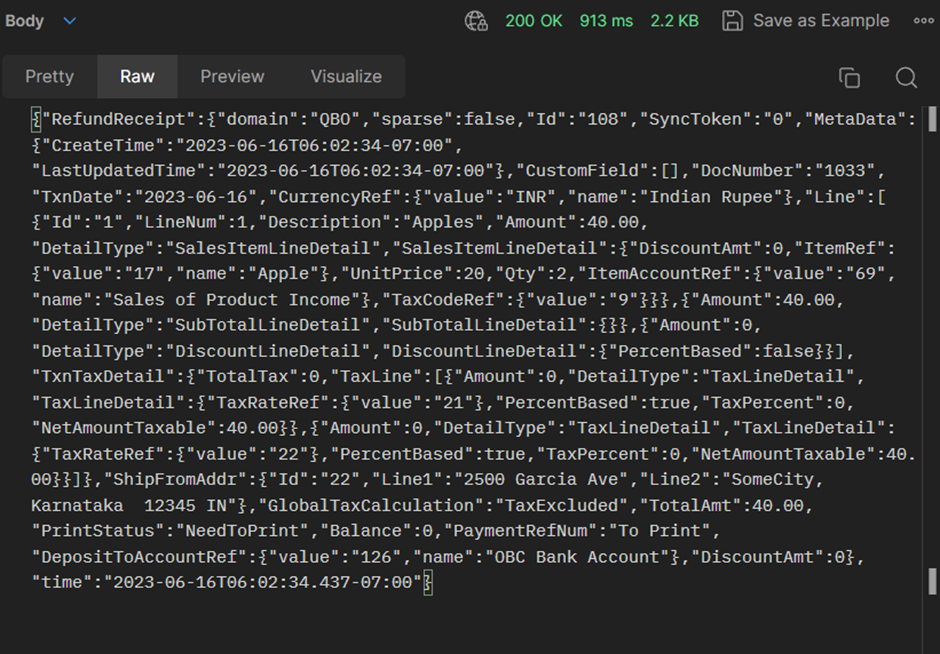

Request Body:

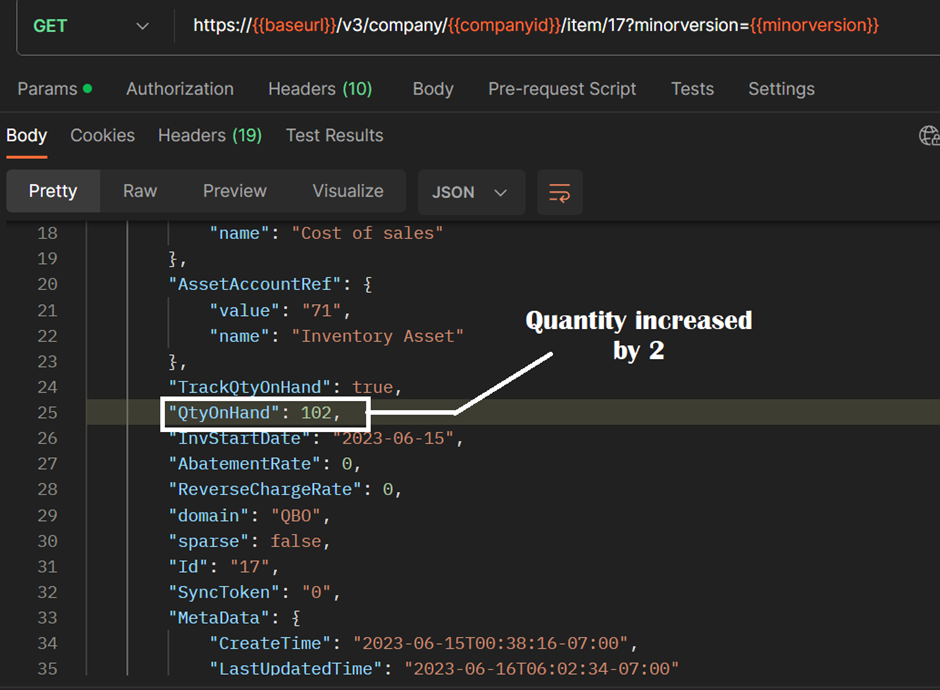

Let’s check the changes in quantity of Items ( Using Get Item API).

Note that the quantity of Apples in the inventory increased by 2

Credit Returns of Item Sales

Now, let us consider a scenario where a customer had the option to pay cash on delivery (COD) but didn’t make the payment, and they decide to return the items. In this case, you won’t generate a refund receipt because no payment was received initially. Instead, you’ll use a “Credit Memo.”

Using a Credit Memo

A credit memo allows you to accurately track the customer’s credit and maintain proper financial records when no payment has been made. It’s a valuable tool for reflecting returns and non-payment in your inventory and financial records.

Creating a Credit Memo

To create a credit memo, make sure the request body includes the following:

- At least one line for either a sales item or an inline subtotal.

- The “CustomerRef.”

Conclusion

Item refunds are an integral part of maintaining accurate financial records and ensuring customer satisfaction in your QuickBooks transactions. Understanding the distinction between “Refund Receipts” for paid cash sales and “Credit Memos” for credit returns of item sales is essential for proper record-keeping and financial integrity. By choosing the right method for your specific situation, you can navigate item refunds with confidence, providing a seamless experience for both your customers and your business.

As we conclude our comprehensive blog series on harnessing the power of QuickBooks for your ecommerce business, we’ve journeyed through four essential parts, each unlocking a new dimension of financial management. From the foundational “Setting Up Store” in Part 1, to the art of efficiently replenishing items in Part 2, and gaining insights into item expenses in Part 3, we’ve laid a strong foundation for your financial success. Now, in Part 4, we’ve explored the intricate world of item refunds, ensuring you have the knowledge and tools to handle refunds seamlessly. With QuickBooks as your trusted ally and the insights gained from this series, you’re well-equipped to optimize your ecommerce operations, streamline your finances, and steer your business toward growth and prosperity. Remember, your financial success is not just a destination; it’s a journey, and we’re here to support you every step of the way.

If you require further details regarding the topics covered in this series or seek assistance with the setup of your ecommerce platform. Please get in touch with us using the contact us form.