Streamlining Stock Keeping With QuickBooks - How item is expensed

August 08, 2023 19:50 pm

Anuradha Mitra

Introduction:

After viewing Part 1 of the series, “Setting Up Store,” and Part 2 of the series, “A Guide to Replenishing Items,” we will now examine how an Item is Expensed. Efficient inventory management extends beyond just tracking products, it encompasses the intricate web of sales transactions. This article delves into the realm of item expenses, specifically focusing on the nuanced process of managing sales transactions. From creating sales receipts for cash transactions to navigating the terrain of sales on account through invoices, we will walk you through the meticulous art of managing customer payments and orchestrating refunds. In this comprehensive guide, we aim to demystify the mechanisms that govern these processes, empowering you to master the art of item expenses.

- The Dynamics of Item Expenses: When a customer makes a purchase, the method of payment can significantly influence the transaction. In this context, we’ll explore two distinct scenarios: immediate cash payments and deferred payments for online purchases. Understanding these dynamics is paramount to catering to diverse customer preferences and ensuring a seamless shopping experience.

- Handling Cash Sales: Creating Sales Receipts

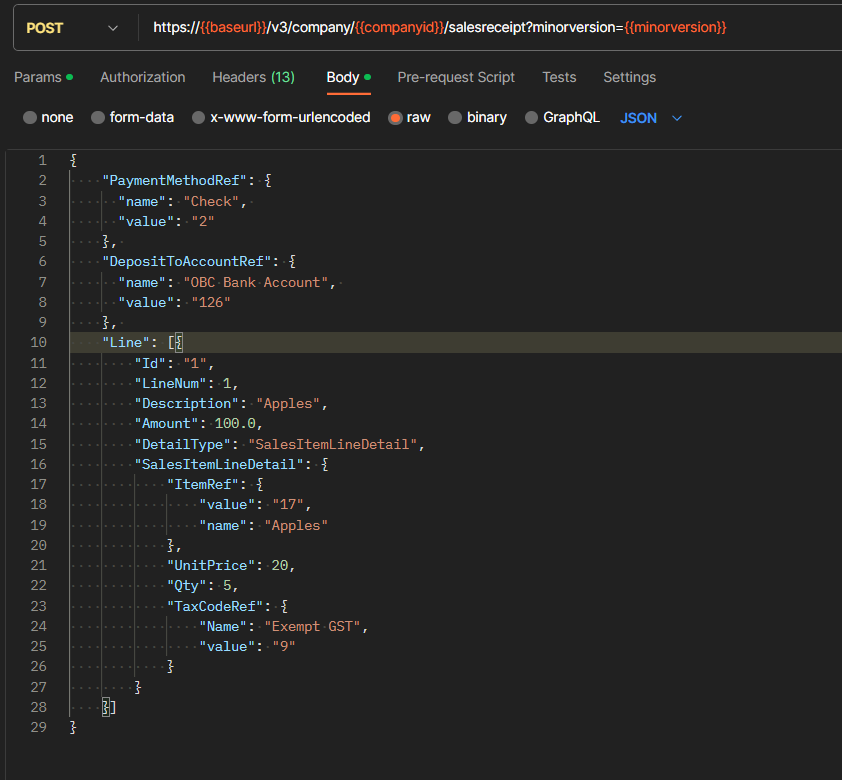

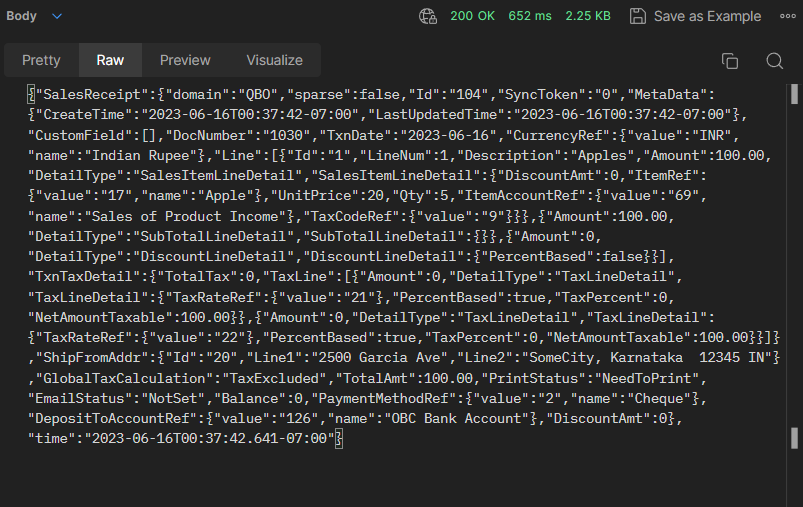

For transactions where immediate payment is made, the Sales Receipt takes center stage. Functioning as a transaction proof for customers, it differs from an invoice as it captures payment at the time of the sale. We’ll illustrate this through an example where a customer orders 5 apples at 20 Rs per apple. The Sales Receipt API comes into play, enabling the creation of the Sales Receipt, complete with various payment methods tailored to the customer’s choice.

Example: In the given scenario, a customer has placed an order for 5 apples at a price of 20 rs per apple. As a result of this purchase, the inventory quantity of apples will decrease by 5 units. To create a Sales Receipt for this purchase, you can utilise the Sales Receipt API. The Sales Receipt can be created using various payment methods such as “check,” cash, or credit card, depending on the customer’s preference.

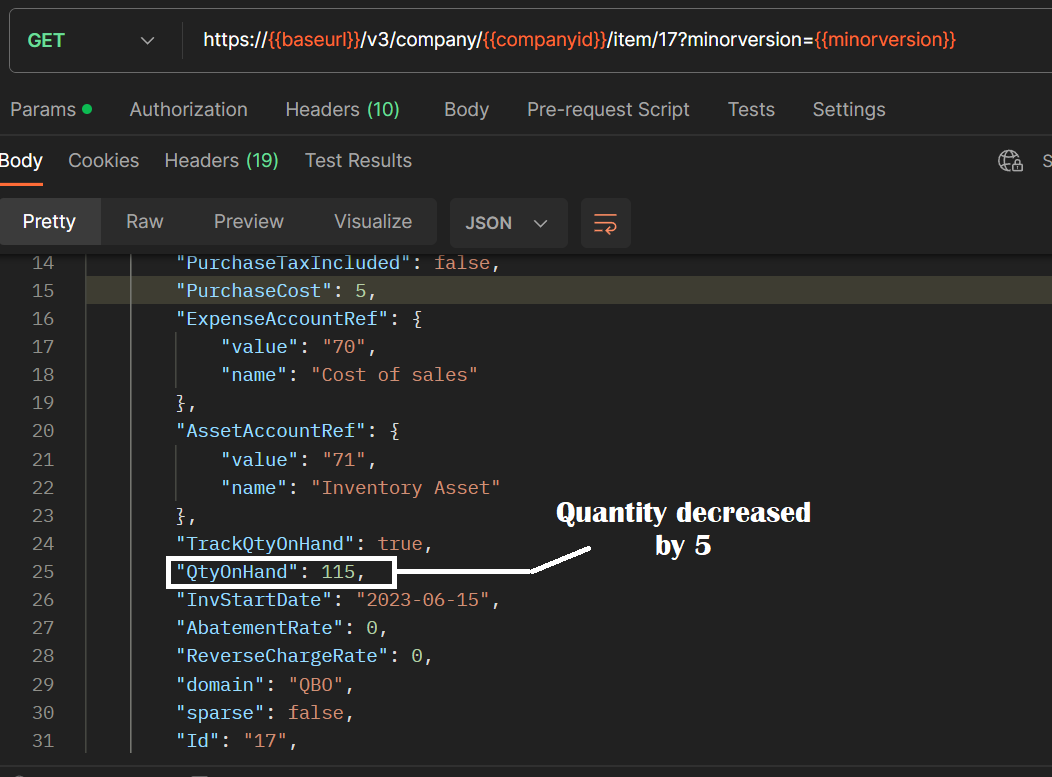

We can check the changes in quantity of Items (Using Get Item API).

It is important to note that the inventory quantity of apples decreased by 5 units as a result of the customer’s purchase of 5 apples.

3. Navigating the Sales Landscape

- Mastering Cash Sales with Sales Receipts:

In scenarios where immediate payment is the norm, the Sales Receipt emerges as your trusted companion. Functioning as a tangible proof of transaction, it goes beyond an invoice by securing payment at the time of the sale. With an illustrative example of a customer ordering 5 apples at 20 Rs per apple, we demonstrate the creation of a Sales Receipt using the Sales Receipt API. Multiple payment methods, including “check,” cash, or credit card, can be seamlessly integrated to meet the customer’s preferences.

- Crafting the Art of Sales “On Account” Through Invoices:

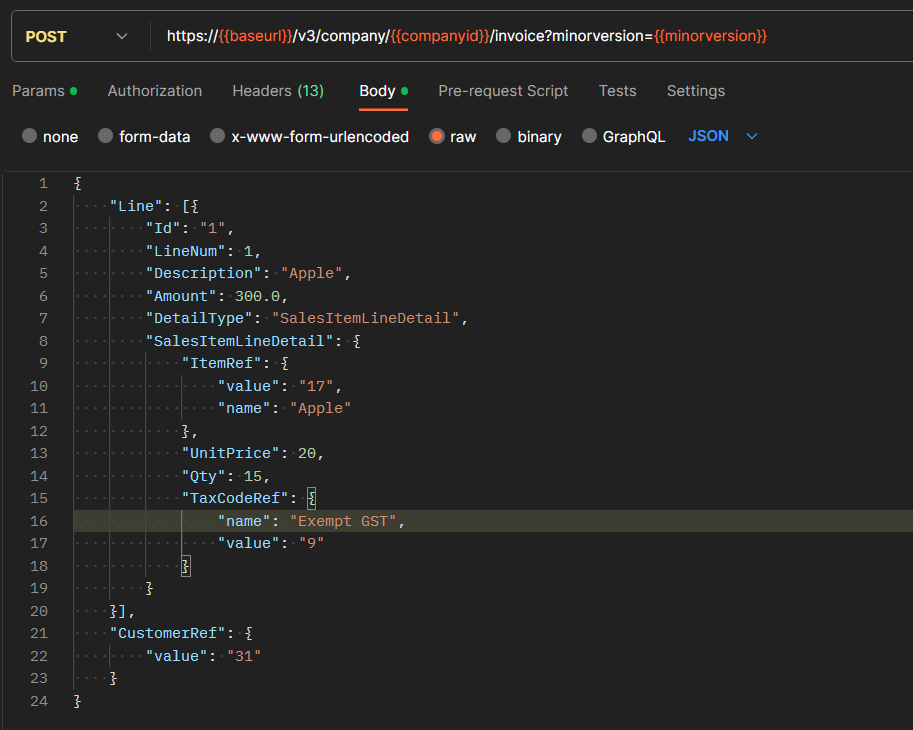

In the realm of deferred payments, invoices come to the forefront. Our journey commences with the creation of a comprehensive invoice, encompassing sales items or inline subtotals. The pivotal link between an invoice and a customer is the CustomerRef, a linchpin ensuring accurate record-keeping.

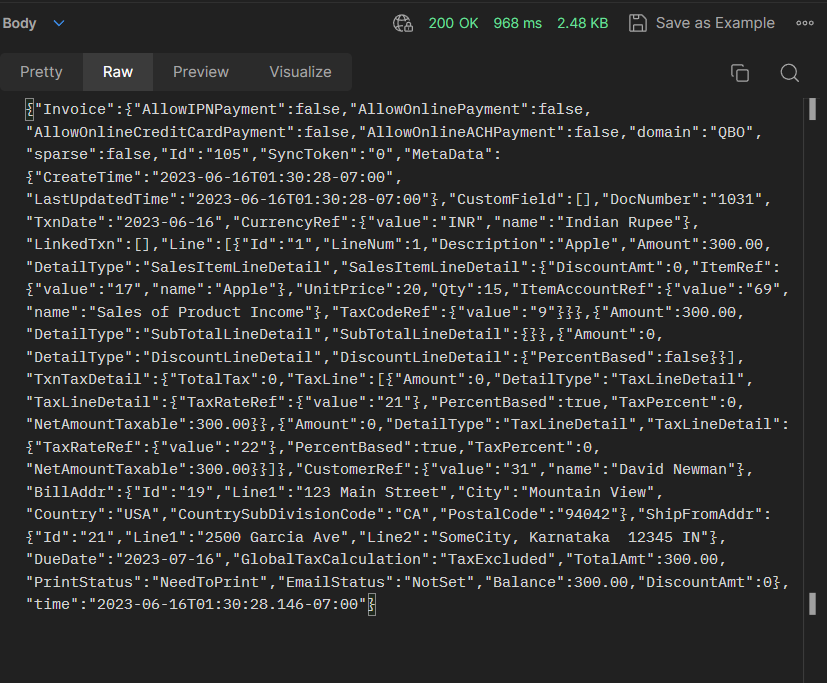

For instance: Let’s suppose, a customer wants to buy 15 apples and it’s a cash on delivery (COD) order, our initial step is to create an invoice for the order. This ensures that the quantity of apples is accurately tracked in our records

- Request Body and URL:

2. Response Body:

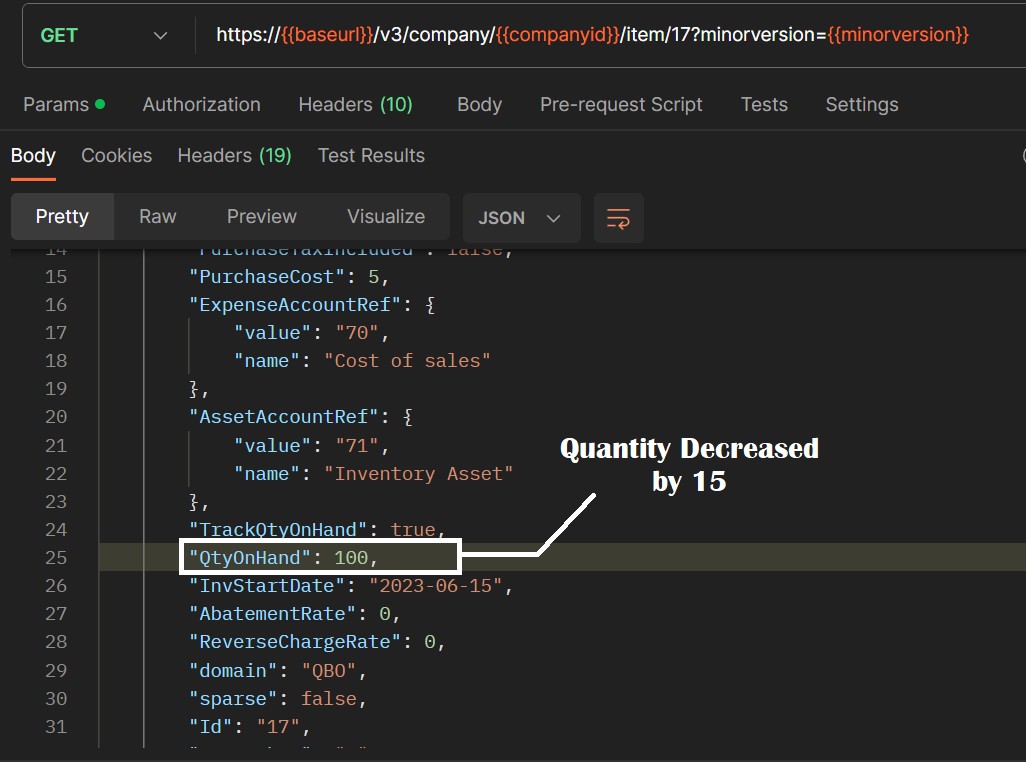

Let’s check the changes in quantity of Items recorded (Using Get ItemAPI).

Note that the quantity of Apple’s inventory decreased by 15 as the order was processed and we created/generated Invoice for the customer.

Conclusion

Item expenses are the heartbeat of inventory management, and QuickBooks equips you with the tools to navigate this realm effortlessly. From crafting sales receipts for cash transactions to orchestrating sales on account via invoices, you’re armed with the knowledge to orchestrate a seamless inventory management symphony. Remember, item expenses transcend mere transactions; they are the keystones to building a resilient and successful ecommerce venture.

Disclaimer

This article is for informational purposes only and should not be considered professional financial or legal advice. For tailored guidance, consult a qualified professional.

In the next part we will discuss regarding Item Refunds

If you want to know more about how we can help, book a meeting for a free consultation.